2018 Tax Withholding Guide Federal

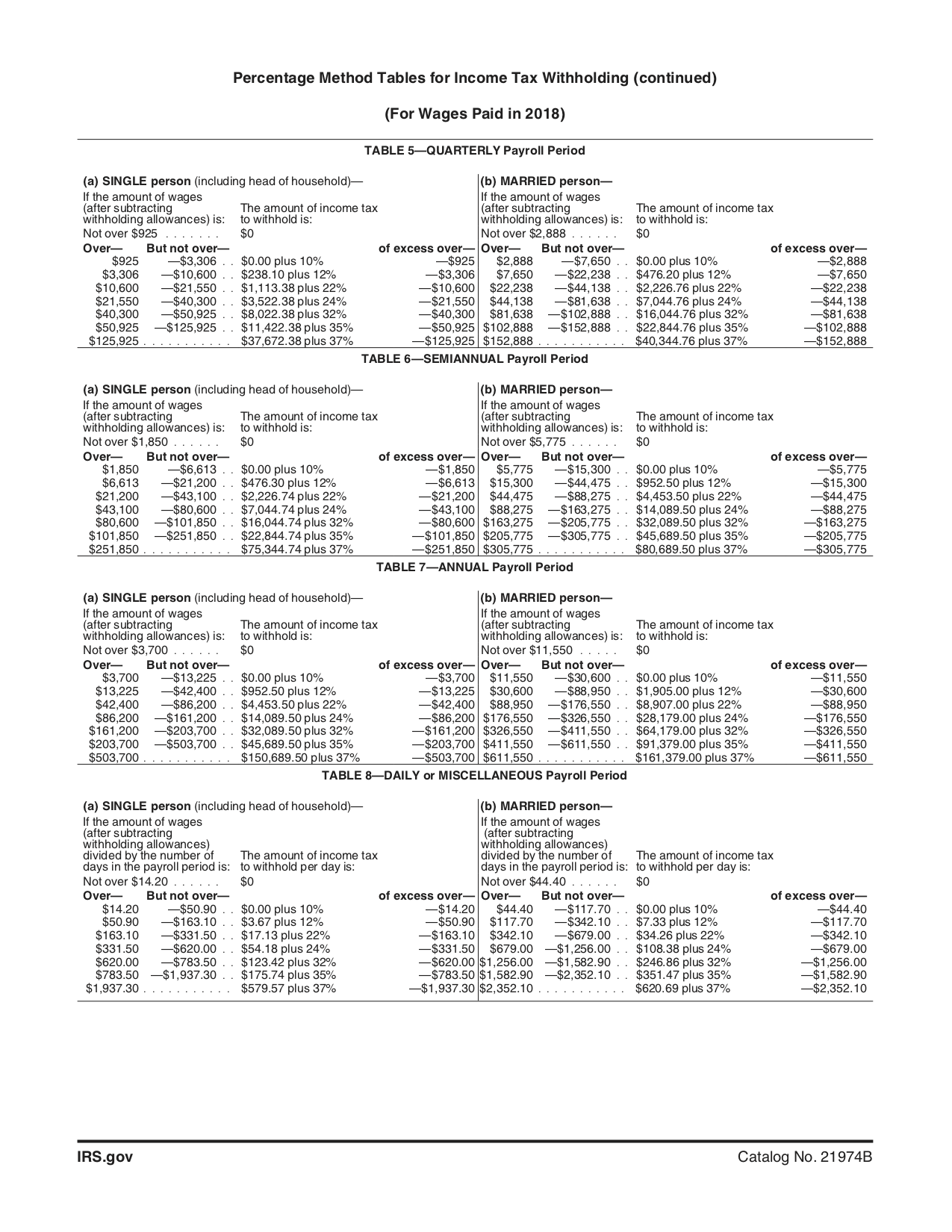

2 TIAA 2018 tax guide 2018 federal income tax rates Married individuals filing joint returns and surviving spouses If taxable income is:* The tax is. Sk 4l60e Manual on this page. Publication 15 Cat. 10000W (Circular E), Employer's Tax Guide For use in 2018. 2018 federal income tax withholding. This publication. Implement the 2018 withholding tables as soon as possi-ble, but not later than February 15, 2018. Continue to use the 2017 withholding tables until you implement the 2018 withholding tables. The new withholding tables are de-signed to work with the Forms W-4, Employee's Withhold-ing Allowance Certificate, that your employees previously gave you. Because of the potential tax changes, the IRS is waiting to release certain guidance for 2018, including the 2018 withholding tables, Form W-4, Employee’s Withholding Allowance Certificate; Circular E, Employer’s Tax Guide (Publication 15); Employer’s Supplemental Tax Guide (Publication 15-A); and Employer’s Tax Guide to Fringe Benefits(Publication 15-B).

What is the state unemployment insurance program? The Federal-State Unemployment Insurance Program provides unemployment benefits to eligible workers who are unemployed through no fault of their own (as determined under State law), and meet other eligibility requirements of State law. 96 Chevrolet Corsica Beretta Repair Manual. Eligibility and benefit amounts are determined by the State's laws where the insurance claims are made.

What is state unemployment insurance? SUI (State Unemployment Insurance) is an employer-funded tax that gives short-term benefits to individuals who have lost or left their jobs for a variety of reasons. Some of these reasons include, but are not limited to, being laid off, being fired for reasons other than misconduct, or leaving due to health or personal problems. Who needs to pay unemployment insurance? In most cases, if you have employees, you must pay unemployment taxes on their wages in the state.

Tax reports or tax and wage reports are due quarterly. Liable employers must submit a tax report every quarter, even if there are no paid employees that quarter and/or taxes are unable to be paid. How much does unemployment insurance cost?

Employer tax rates vary by state and typically fall within a range based on number of unemployment claims associated with your business. The more claims filed, the higher your tax rate becomes. What are the benefits of using a third-party service to handle my SUI filings? Unemployment administration can become cumbersome and costly for business owners, who must maintain current paperwork and respond to claims in a timely manner, or else face costly penalties. We can help you obtain your SUI numbers from the state for only $ 99.

Our SUI service works with Paychex Payroll to help your business save time, administrative hassles, and costs commonly associated with unemployment administration. Terms and conditions, features, support, pricing and service options subject to change without notice. Copyright © 1997-2018, MyCorporation All Rights Reserved.

MyCorporation is a Document Filing Service and CANNOT provide you with legal or financial advice. The information on the website is designed to provide accurate and authoritative information in regard to the subject matter covered. It is presented with the understanding that MyCorporation is not engaged in rendering legal, accounting or other professional services. If legal advice or other professional assistance is required, the services of a competent professional person should be sought. From a Declaration of Principles jointly adopted by a Committee of the American Bar Association and a Committee of Publishers and Associations.

Comments are closed.